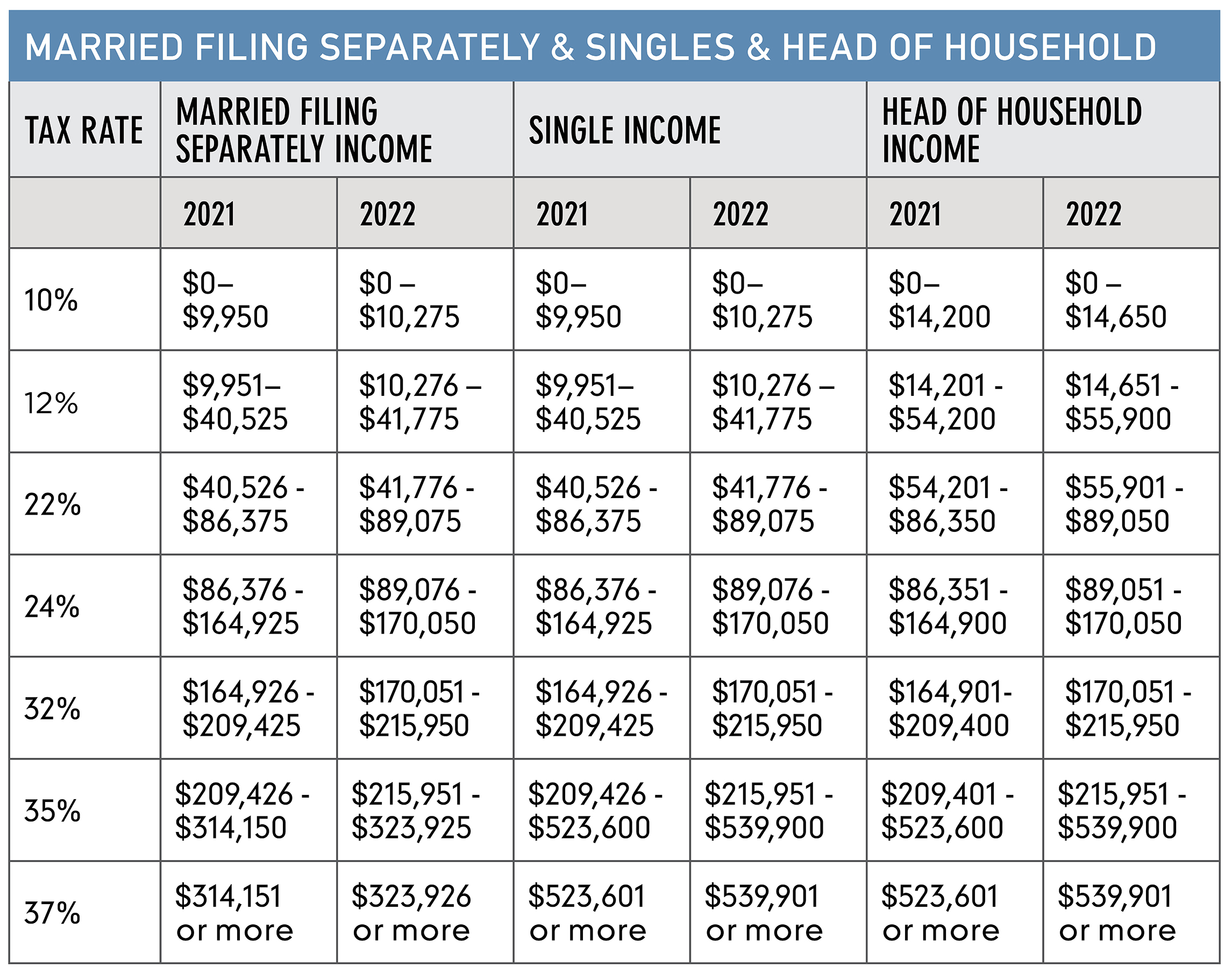

2025 Tax Brackets Married Filing Separately. There are seven tax brackets for most ordinary income for the 2025 tax year: Married couples filing jointly received an. Get every dollar you deserve* when.

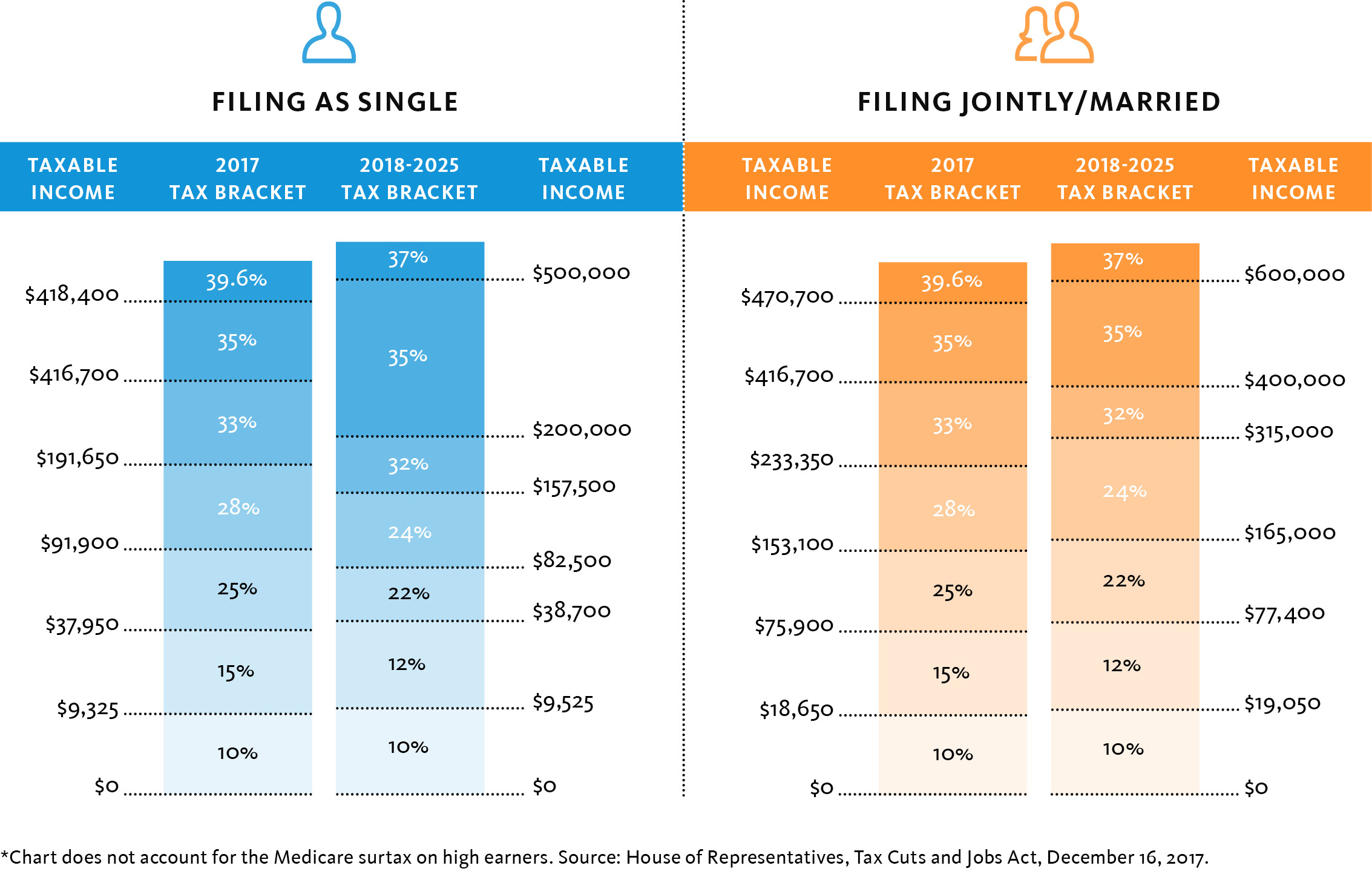

How does “married filing separately” work? The top tax rate for 2025 will remain at 37% for individual single taxpayers with incomes greater than $609,350, or $731,200 for married couples filing jointly.

Cuddy Financial Services's Tax Planning Guide 2025 Tax Planning Guide, Amt exemptions phase out at 25 cents per dollar earned once amti reaches $609,350 for single filers and. Efiling is easier, faster, and safer than filling out paper tax forms.

About Tax Brackets Married Filing Jointly Es Article, Understanding how your income falls into different tax brackets can help with tax. Married filing separately all others.

50 Unveiled Benefits of Married Filing Separately Ultimate Guide 2025, Here are the 2025 tax brackets, for tax year 2025 (returns filed in 2025). 2025 tax brackets (for taxes filed in 2025) the tax.

Tax Brackets Definition, Types, How They Work, 2025 Rates, The top tax rate for 2025 will remain at 37% for individual single taxpayers with incomes greater than $609,350, or $731,200 for married couples filing jointly. The excess income ($35,000 minus $11,600, or $23,400) will be taxed at 12%, yielding $2,808.

2025 Tax Brackets Calculator Sukey Engracia, Here are the 2025 tax brackets, for tax year 2025 (returns filed in 2025). Knowing your federal tax bracket is essential, as it determines your federal.

Married Filing Jointly Tax Brackets 2025 2025 Hope, The top tax rate for 2025 will remain at 37% for individual single taxpayers with incomes greater than $609,350, or $731,200 for married couples filing jointly. Amt exemptions phase out at 25 cents per dollar earned once amti reaches $609,350 for single filers and.

Married Filing Separately Q&A TL;DR Accounting, More guides and other resources. Page last reviewed or updated:

How to Do Your Own Taxes A Beginners Guide, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the. File your federal and federal tax returns online with turbotax.

The 2025 Tax Brackets by Modern Husbands, Understanding how your income falls into different tax brackets can help with tax. Get every dollar you deserve* when.

Tax Brackets 2025 Married Jointly California Myrle Tootsie, In 2025, the standard deduction for married couples filing jointly is $29,200, compared to $14,600 for those filing separately. Understanding how your income falls into different tax brackets can help with tax.

In 2025, the 28 percent amt rate applies to excess amti of $232,600 for all taxpayers ($116,300 for married couples filing separate returns).