Head Of Household Vs Single 2025. Marginal tax brackets for tax year 2025, head of household. The size of your standard deduction depends largely on your tax filing status.

Head of Household vs Single Top Differences, Infographics, Single, married filing jointly, married filing separately, or head of household. Should i file as single or head of household?

Head of Household vs. Single The Differences Explained The Knowledge Hub, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. And with a larger standard deduction — $18,800 compared with $12,550 for single filers in 2025— your.

Head of Household vs. Single The Differences Explained The Knowledge Hub, Rate married filing jointly single individual head of household married filing separately; For the 2025 tax year, the standard deduction for a head of household is $20,800, compared to just $13,850 for a single filer.

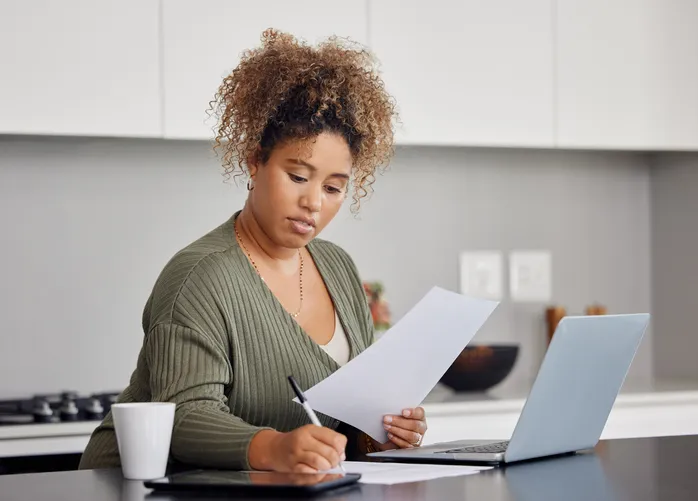

Tax Filing Head of Household vs. Single SmartAsset Business News, Single, married and head of household. Page last reviewed or updated:

Head of Household vs. Single The Differences Explained The Knowledge Hub, Should i file as single or head of household? And with a larger standard deduction — $18,800 compared with $12,550 for single filers in 2025— your.

Single vs. head of household how it affects your tax return Market, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. Ever wonder what the difference is between a single filer and a head of household filer?

Head of Household vs Single Explained, Single, married filing jointly, married filing separately, or head of household. It’s less than the standard deduction.

Head of Household IRS Rules Simplified ! Internal Revenue Code, Head of household filing status has lower rates and a larger deduction. Additional amount for married seniors:

Head of Household vs. Single The Differences Explained The Knowledge Hub, Should i file as single or head of household? To figure out your tax bracket, first look at the rates for the filing status you plan to use:

开云棋牌正版单身和户主之间的差异比较相似术语之间的差异, Head of household status is available to any taxpayer who is unmarried, pays for at least half their household’s expenses and has a qualifying dependent living at home. For example, in tax year 2025 the head of household 12% tax bracket is $63,100 (which is up from $59,850 in 2025) of taxable income compared with just.